Have you been facing issues with Business Central VAT posting dates since the New Year began? You’re not alone. Microsoft’s recent updates to the VAT setup have caused some unexpected challenges for users returning from their holiday break. Let’s dive into what’s happening and how to fix it.

Understanding the New Changes in Business Central VAT Posting Dates

Microsoft has introduced a new ‘VAT Setup’ page in Business Central that’s changing how posting dates work. Here’s what you need to know:

The New VAT Date Controls

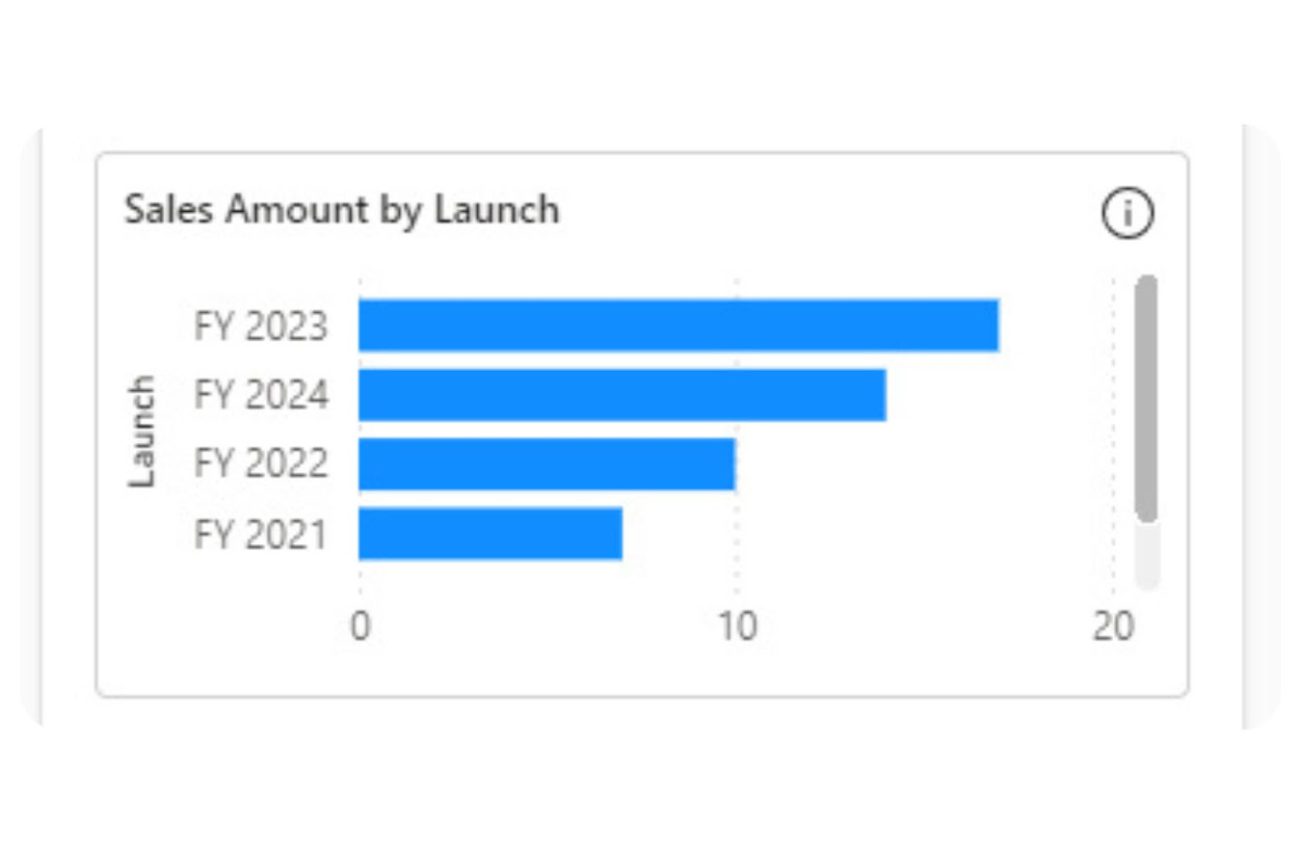

The system now includes two crucial date parameters:

- ‘Allow VAT Date From’

- ‘Allow VAT Date To’

These controls restrict postings that use VAT dates outside their specified range, unless a user has special permissions.

Why Are You Experiencing Issues?

Here’s what happened behind the scenes:

- Microsoft previewed this feature in November

- It went live in December

- During activation, the system used whatever dates were in your General Ledger Setup

- This happened regardless of whether your VAT date functionality was active

- Result? Users returning in January found they couldn’t post because the system was still using December’s settings

How to Fix the Problem

The solution is straightforward but requires careful attention:

Step-by-Step Resolution:

- Access the VAT Setup Page

- Navigate to the new VAT Setup section

- Review your current date settings

- Update Your Date Settings

- Align dates with either:

- Your current posting date control, or

- Your next VAT return period

- Align dates with either:

- For Disabled VAT Date Usage:

- Temporarily enable the VAT Date feature

- Clear the date fields

- Disable the feature again

For more information, visit here.

Important Safety Tips:

- Pause all system activity during these changes

- This prevents new documents from being created with incorrect VAT dates

- The issue typically only needs to be fixed once

- Monitor the system after changes to ensure everything works correctly

Best Practices Moving Forward

To prevent future issues:

- Include VAT Setup page reviews in your month-end checklist

- Keep your date ranges aligned with your posting periods

- Regularly verify user permissions in the User Setup page

- Document any changes made to VAT date controls

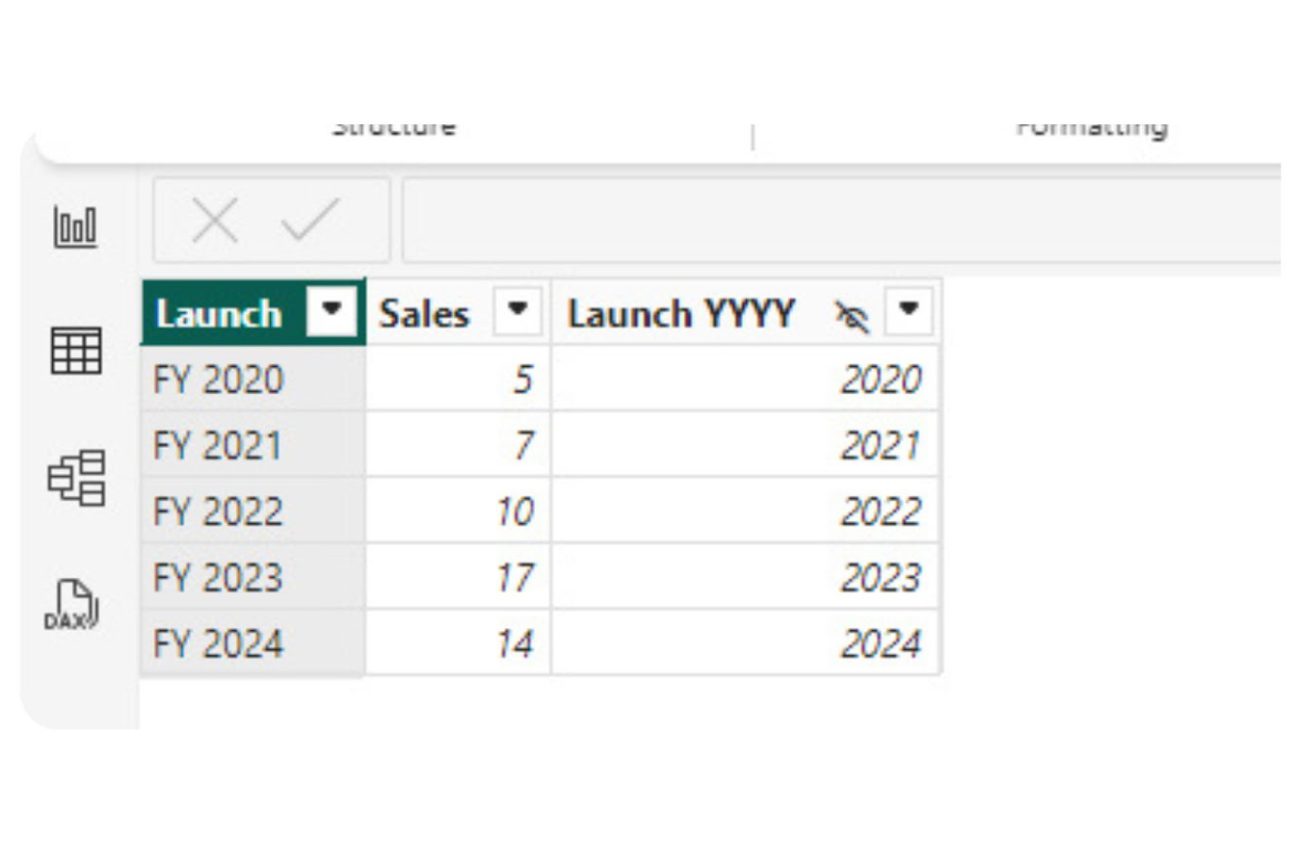

Understanding User Setup Changes

The User Setup page now includes additional columns that allow you to:

- Grant exceptions to specific users

- Enable VAT date postings outside the standard range

- Manage posting permissions more granularly

Important Disclaimers

Remember:

- These are technical system configurations, not VAT advice

- Consult with appropriate tax professionals for VAT-related decisions

- The settings described are examples, not recommended configurations

- Always align your setup with your organisation’s specific needs

Need Additional Support?

If you’re still experiencing issues or need expert guidance:

- Reach out to Business Central support specialists

- Consider having an expert review your setup

- Document any specific issues you’re experiencing

- Keep track of any error messages you encounter

Conclusion

Remember, while these changes may seem disruptive initially, they’re designed to provide better control over VAT data management in the long run. Stay proactive with your system maintenance, and don’t hesitate to seek expert help when needed.

Want to stay updated with more Business Central tips and tricks? Sign up for our newsletter to receive regular updates and helpful guides directly in your inbox.

Speak to an expert for a 1:1 consultation here.